Keep Your Credit Union Human

With an average member age of 53, credit unions are investing heavily in digital transformation in an effort to attract younger members. However, data shows that Gen Z and millennials value member-ownership, community focus, and personalized service. The human impact of “people helping people” cannot be replaced by technology. To stay competitive, credit unions must prioritize and promote their Human Culture.

With an average member age of 53, credit unions are investing heavily in digital transformation in an effort to attract younger members. However, data shows that Gen Z and millennials value member-ownership, community focus, and personalized service. The human impact of “people helping people” cannot be replaced by technology. To stay competitive, credit unions must prioritize and promote their Human Culture.

Key Takeaways:

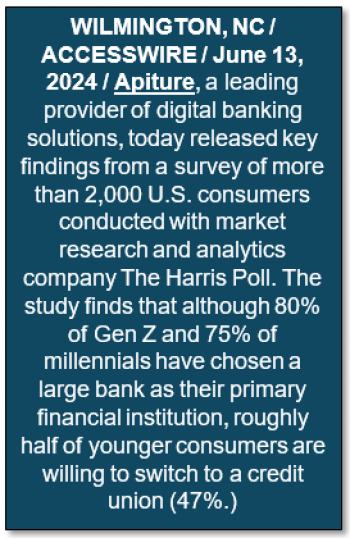

· According to recent polls, 47% of GenZ consumers are open to switching from their current banks to credit unions.

· For many GenZ and Millennial consumers Human Culture is as important as Digital Culture. They want personal, not artificial service.

· The key is to Serve People with Technology, but Help People with People.

· Case Study: TQC TEAM CUSO delivers a Unique Human Culture-Focused Talent Acquisition Strategy that reduces turnover and saves credit unions millions of dollars when compared to traditional agency strategies.

ON THE SURFACE, DIGITAL TRANSFORMATION MAY HELP LEVEL THE PLAYING FIELD BETWEEN CREDIT UNIONS AND OTHER FINANCIAL INSTITUTIONS. HOWEVER …

The “leveling effect” will neither lower the average age of credit union members nor provide the humanization sought by younger Gen Z and millennial consumers. Credit unions are rapidly embracing digital banking for its convenience and accessibility. According to WalletHub, “77% of consumers prefer digital banking, with 55% using mobile apps and 22% managing accounts via computer.” In 2024, the tech-savvy key words were “digitalization” and “personalization.” In 2025, credit unions need to focus on one more critical strategy: “humanization.” Let’s take an even closer look:

· Digitalization: Digital transformation is the process of using technologies to change a business’s processes, culture and customer experiences to meet changing business and market requirements.

· Personalization: Personalization is the first step in offering a user experience tailored to the individual as opposed to a cold interaction fit for the masses. This encourages consumers to proceed by opening an email or clicking a link. It warms consumers up to trusting a brand in hopes they will continue moving down the path to transact.

· Hyper-Personalization: A study by Selligent Marketing Cloud found that 74 percent of consumers expect to be treated as an individual rather than a segment. By leveraging real-ime data, financial brands develop a better understanding of their customers and their needs. This in turn lets customers know they are valued on a personal level, which builds their trust and the likelihood of repeat business.

· Hyper-Personalization: A study by Selligent Marketing Cloud found that 74 percent of consumers expect to be treated as an individual rather than a segment. By leveraging real-ime data, financial brands develop a better understanding of their customers and their needs. This in turn lets customers know they are valued on a personal level, which builds their trust and the likelihood of repeat business.

· Humanization: (Not available online.) Efficiency aside, on either your cell phone or your computer you can’t tell the difference between a bank and a credit union. If it looks like a duck, walks like a duck and quacks like a duck, how do you know it isn’t a duck? The difference is when you pick up the telephone or walk in the door.

Digitization, even with personalization, doesn't always strengthen member bonds—chatbots, for example, can't convey culture, foster loyalty, or show empathy.

With the average credit union member now 53 and aging, credit unions are eager to attract younger members. Baby Boomers, who borrow less in retirement, make up 39% of membership, making it essential to engage more Gen Z (13-27) and Millennials (28-44).

Younger, tech-savvy members want more than just online convenience.

McKinsey’s 2023 Consumer Financial Life Survey reveals that Gen Z and millennials value credit unions' commitment to social impact. Gen Zers who switched institutions cited better service, rates, and community support, presenting an opportunity for credit unions to engage this generation by emphasizing service, competitive rates, and community involvement. The McKinsey survey goes even further in exposing key drivers of building Gen Z and millennial relationships. In their study, “Six Imperatives for Credit Unions to Secure Their Future” four of the top drivers cited by participants as reasons for switching a financial institution were:

To read the complete whitepaprer: Click Here