STUDY REVEALS EFFECTIVENESS OF INVESTMENT MANAGERS’ USE OF ALTERNATIVE DATA

According to a new study from fintech Exabel with portfolio managers and investment analysts who focus on fundamental investing on their use of alternative data just 23% describe their organisation’s process for using it as ‘excellent’. Some 63% describe it as good, but around one in eight (12%) say it is average.

Alternative data is defined as non-traditional data that can provide an indication of future performance of a company outside of traditional sources such as company filings, broker forecasts, and management guidance. Exabel provides investors with a platform to make the most out of alternative data within their investment processes.

The process to extract benefits from alternative data can be challenging. Just 28% of investment professionals surveyed by Exabel think the funds they help to manage do a very good job in integrating alternative data into their processes. Over six out of ten (61%) believe they do this quite well, but one in ten (10%) describe their ability to do so as average.

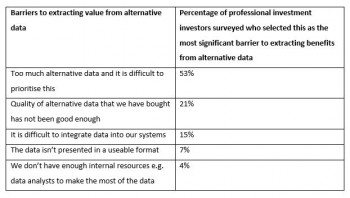

When asked what the most significant barrier to extracting benefits from alternative data is, 53% of investment professionals surveyed said there is too much of it and it is hard to prioritise, followed by 21% who said its quality is sometimes not good enough. Some 15% identified difficulties in integrating alternative data into their systems as the biggest challenge.

Neil Chapman, CEO Exabel said: “Our research shows that active investment managers are relying on alternative data more to support their investment research and strategies. However, our findings also reveal there are challenges that they face in terms of how they use this data and extracting benefits from it. Critically, with advances in domain specific technology, the insight that fund managers can derive from alternative data is increasing rapidly.”

Neil Chapman, CEO Exabel said: “Our research shows that active investment managers are relying on alternative data more to support their investment research and strategies. However, our findings also reveal there are challenges that they face in terms of how they use this data and extracting benefits from it. Critically, with advances in domain specific technology, the insight that fund managers can derive from alternative data is increasing rapidly.”

Exabel has produced a report on its new research findings that can be downloaded for free via this link: https://i.exabel.com/alternative-data-research-report-2023

Exabel’s solution platform brings the investable insights from alternative data direct to investment teams, delivered on its cloud platform providing investment managers with unique insights using alternative data.

Exabel works with market-leading alternative data vendors across the globe to assist them in productizing their data for investors.